Secure and verified

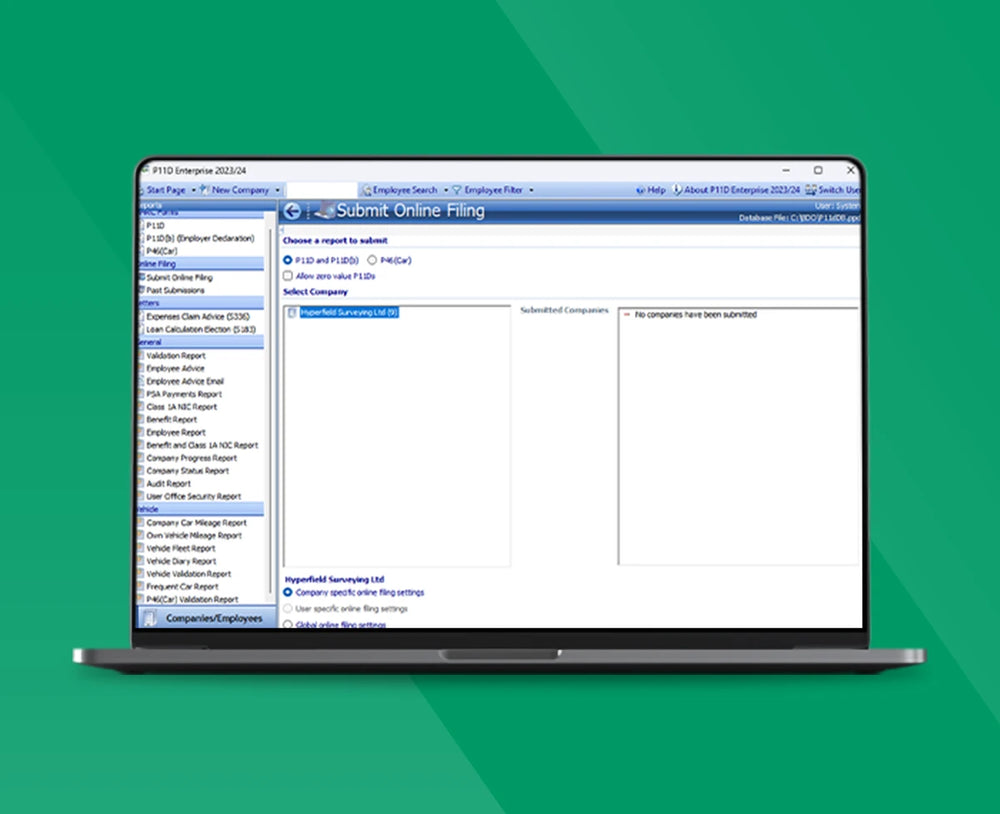

HMRC-recognised and fully compliant software integrates with the government gateway for verified, direct online submissions and audit paper trails of P11D, P11D(b) and P46(Car)

Simple benefits in kind reporting software. Renewal pricing from:

A simple, efficient way to file P11D reports, for businesses of all sizes.

Software is used by thousands of employers and many of the top 20 accountancy firms.

Purchase or renew single or multiple user licences depending on your needs.

Tailor user permissions by employee, department or company.

Technical support team on hand to help resolve your P11D Software technical and product queries via phone call or email.

BDO’s P11D Software is designed to help create smooth and efficient processes for any size of business, from 1-10,000+ employees, in any industry.

You can install and start using the standard P11D Software in minutes. Alternatively, we are able to integrate P11D Software into your existing systems, providing a fully tailored expenses and benefits solution.

If your business is based in the UK or EU and is reporting in GBP, then trust our HMRC-backed software to deliver accurate and efficient P11D filings.

BDO’s P11D Enterprise Software clients can contact our technical support team for assistance with IT-related software issues via phone or email from Monday to Friday between 9am – 5pm.

To make sure we stay independent, we will refund your transaction if we find a conflict of interest.

Choose single or multiple licences when you add to basket. Log in or open an account during checkout.

Once you have paid, we will begin our conflict of interest checks to make sure we can sell you this software.

Your software and licence key will be made available for download in your account.

Speak to our specialist team now for help with your P11D processes.