1. Get in Touch

Contact us for a no obligation demonstration of our TOMM Tool. We will discuss your unique requirements and provide you with a quote.

Assess the maturity of your tax operations

Our Tax Operations Maturity Model (TOMM) is a simple-to-use diagnostic tool based on established international principles to assess the relative maturity of your tax operations, your tax governance and your underlying control framework.

TOMM provides transparency over your tax risks and identifies gaps in your tax control framework, allowing your key stakeholders to make informed and targeted management decisions which can directly support your strategic tax objectives.

It is driven by the completion of an online tax operations assessment which captures your approach to tax across approximately 100 data points. The assessment is made up of multiple choice questions that can be sent to different parts of your business if operations are autonomous. The outputs from the assessment drive a tax maturity score which is representative of the relative strengths of each part of your business. Each area is deliberately jurisdictional agnostic, allowing it to be deployed across your global organisation. Its completion does not specifically require tax specialist input.

TOMM covers a broad range of tax management issues, including Corporate Income Tax, Indirect Taxes, Customs, Employment taxes etc. as well as focusing on areas such as tax governance, local tax capabilities, use of technology, tax reputation and risks around commercial substance.

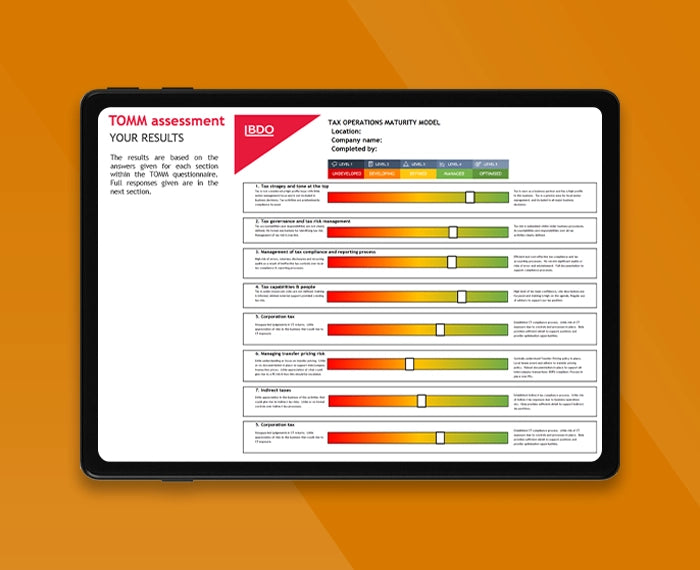

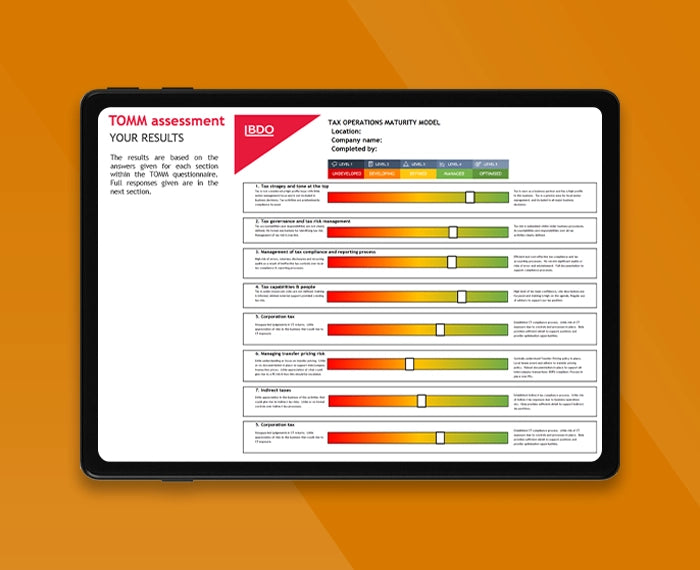

Once you have completed the TOMM you will receive a summary Tax Operations Report. The report provides a Red/Amber/Green traffic light summary across each part of your business / territories, analysing your results against the expected benchmark relevant to each area.

If your business undertakes multiple diagnostics by division, entity or jurisdictions then there is value in comparing the relative maturity and sophistication of each. The TOMM will identify common areas of weakness (e.g. Transfer Pricing Documentation, weak import controls etc.), as well as isolated weaknesses which impact only parts of your operations.

Unfortunately, we are unable to enter into an Agreement with you if we find a conflict of interest.

Contact us for a no obligation demonstration of our TOMM Tool. We will discuss your unique requirements and provide you with a quote.

Once you have expressed interest in purchasing TOMM, we will commence client onboarding and conflict of interest checks to ensure we can sell you the product.

We will make the tool available to you along with other optional advisory services.