Safe and smart approach

If you would like a demo of this tool, or to get advice about costs associated with international employee mobility, contact us. We'd be delighted to connect with you.

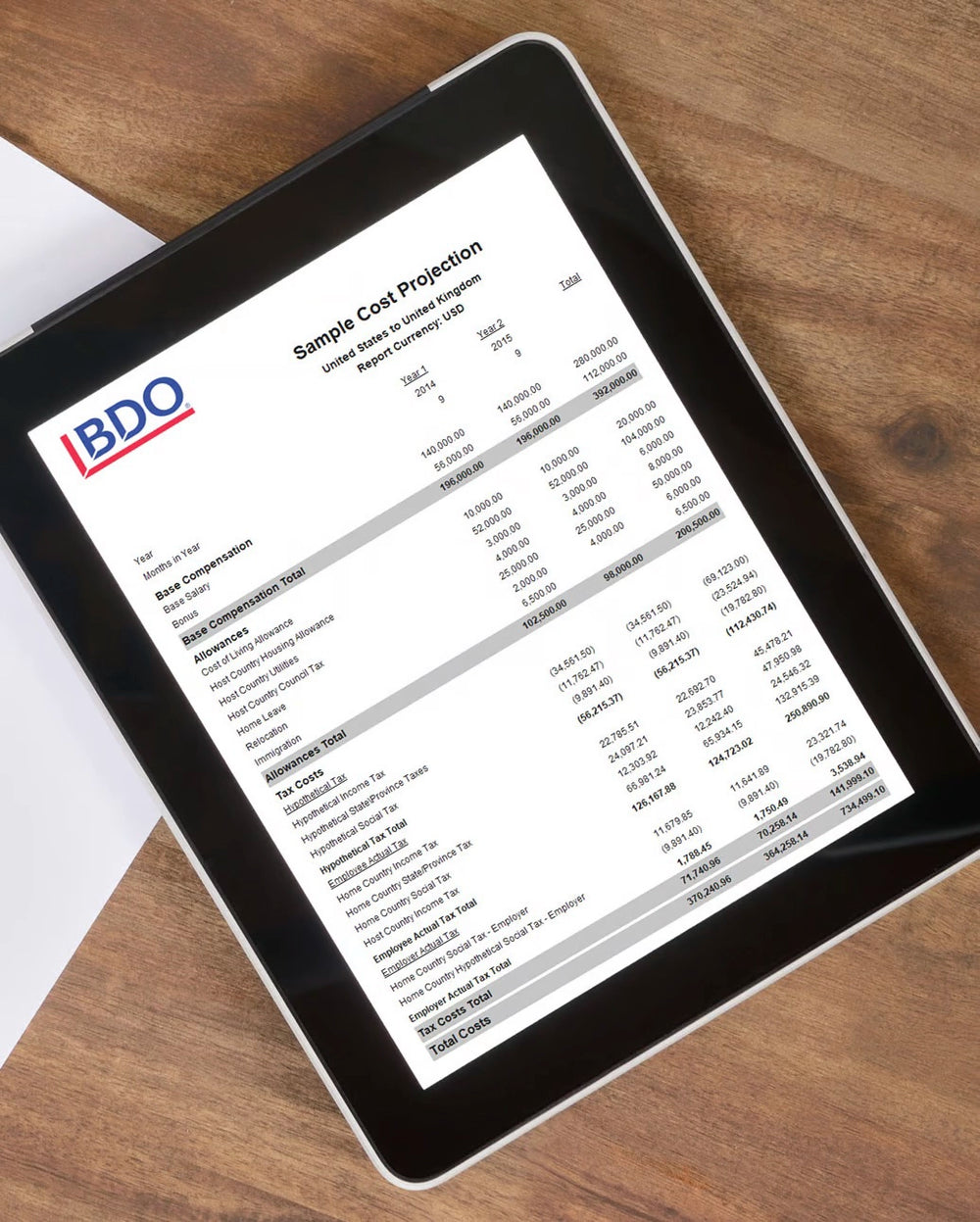

Calculate cost-efficient global mobility assignments.

If you would like a demo of this tool, or to get advice about costs associated with international employee mobility, contact us. We'd be delighted to connect with you.

To make sure we stay independent, we will refund your transaction if we find a conflict of interest.

For self- and web-hosted, add the standard version of the course to your basket. Log in or open an account during checkout.

Once you have paid, we will begin our conflict of interest checks to make sure we can sell you this training.

We will communicate with you regarding the fulfilment of your order in line with the hosting option that you have selected.