Fully automated digital approach or a service-led approach using our equity specialists

In an increasingly globalised world, executive compensation decisions must be made with the foresight of employee mobility. The taxation of incentive and equity-based compensation may vary greatly depending on the type of award, the structure of the organisation, the tax attributes of the recipient, and their location.

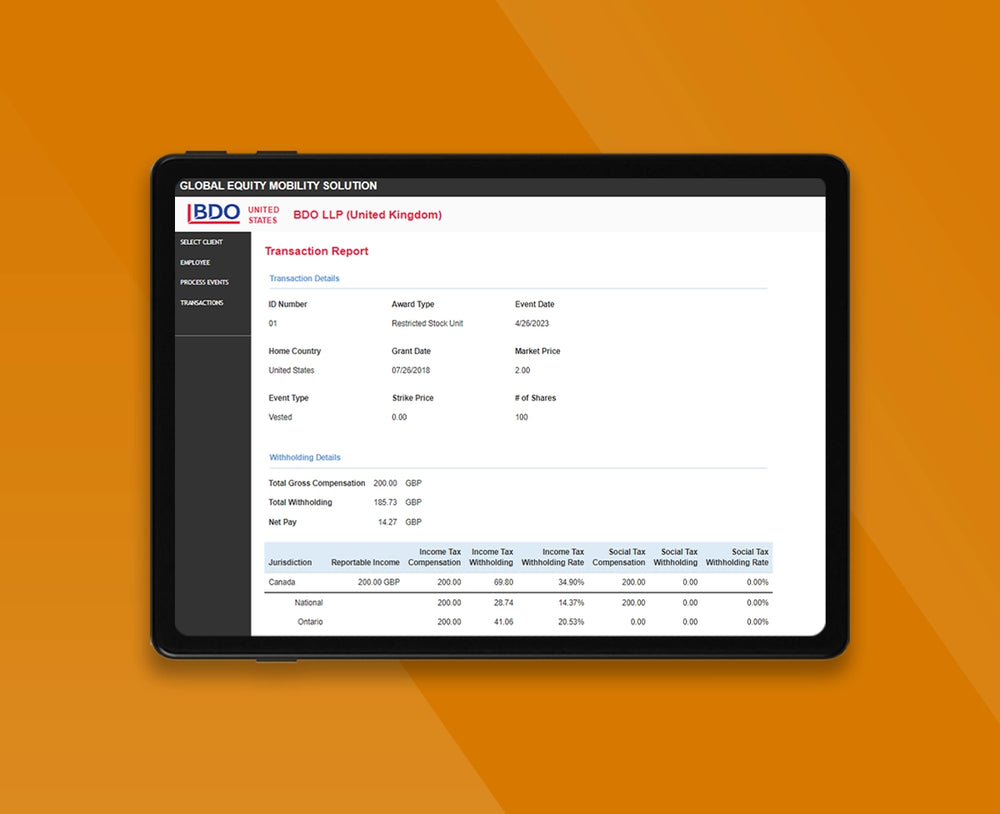

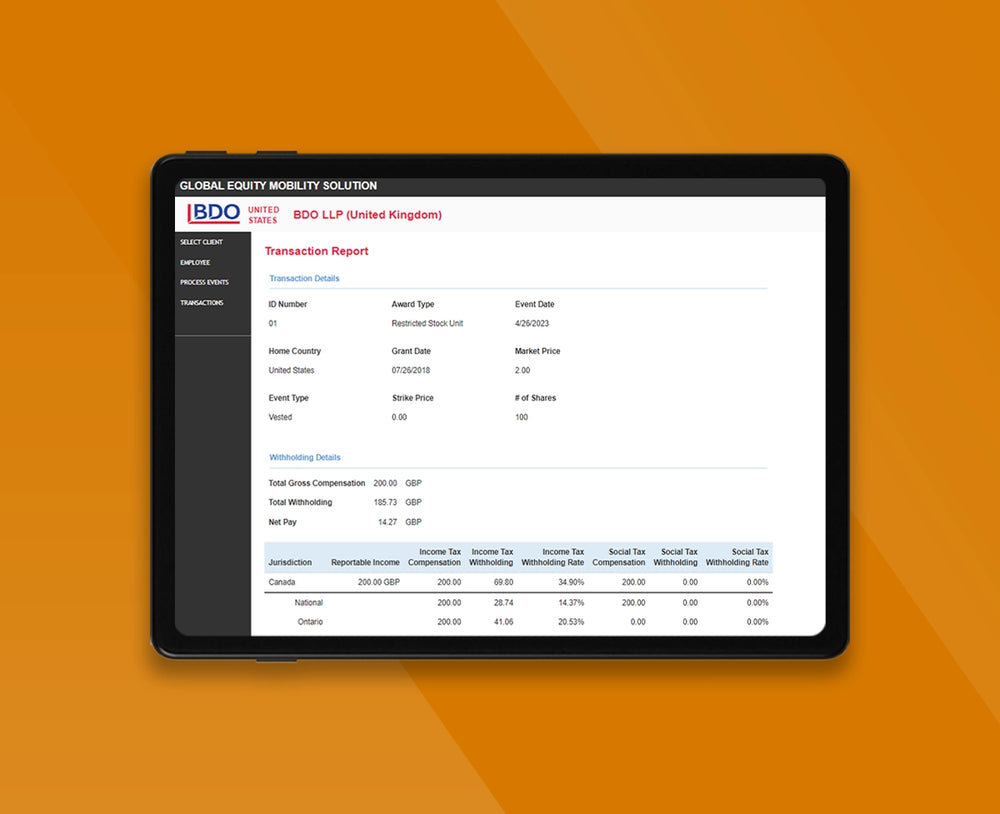

BDO’s Global Equity Mobility Solution (GEMS) is an automated tool that helps companies avoid risk and consider tax-saving opportunities when designing cross-border incentive compensation. By combining transaction data and travel information, GEMS provides real-time calculations of tax withholdings for an organisation’s mobile employees. GEMS calculates payroll withholding using marginal, maximum rates, but can also calculate based on individual year-to-date earnings.

Companies that fail to accurately withhold taxes on incentive compensation subject themselves to a time-consuming and expensive correction process. BDO’s end-to-end solution combines tax and employee data, streamlined technology, and award-winning service to help companies comply with onerous regulatory requirements.