Easy to use – no tax or NIC knowledge needed

If your business needs to downsize, restructure or consider redundancies, the tax and national insurance contributions (NIC) complications can add to an already difficult process. Getting it right is critical to avoiding unexpected liabilities, costly mistakes or reputational damage.

When you make a termination payment, getting the tax/NIC right can be a minefield. Each case will be different and ensuring you have clearly understood the facts before calculating any potential tax/NIC liabilities is crucial. These calculations are often made in challenging circumstances for both you and your employees, adding to the pressure of getting them right.

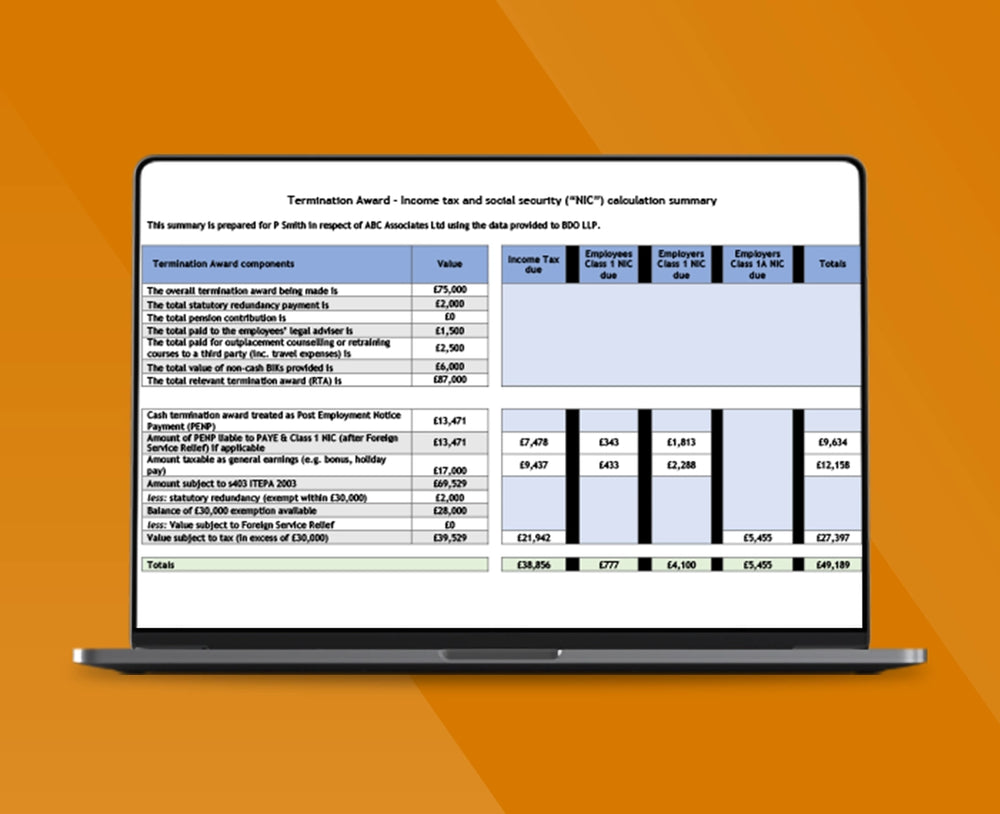

Our bespoke calculator requires no tax technical knowledge to use and removes this complexity, and is designed to ensure your compliance, provide detailed analysis, and an audit trail with a bespoke report that can be shared with the employee. Coupled with expert guidance, it’s your key to making informed decisions with confidence.